What is a Credit Report Dispute Form?

Credit reports are a detailed version of all the credits that are involved with your account. However, there might be cases where there are written inaccuracies within your reports. To counter such reports, the law states the existence of the "604 dispute letter", more commonly known as the 609 dispute letter. The 604 act letter, which explains itself as the Credit Report Dispute form, outlines all the inaccuracies and limitations across the credit report.

Countering the negative information across your credit report is vital since it lowers your credit scores. This is the only reason that majorly provokes users to file a credit report dispute form under the rules put forth by the FCRA. The dispute letter potentially helps the filer to request the removal of all inaccuracies and errors within the report.

Information Required on a Credit Report Dispute Form

The credit report dispute form is believed to be crafted under regulations put forth by the FCRA under Section 604. However, if users intend to create a well-crafted credit report dispute form to improve their credit score, they need to fulfill a few things. This set of information should be a part of the dispute form, which are stated as follows:

- Credit report with the encircled accounts in question.

- Birth certificate of the applicant.

- Social Security Card of the applicant along with their Passport, if present.

- Any state-issued identification card for the verification of citizenship.

- Tax document displaying the SSN.

- Rental agreement or mortgage contract with the name and address of the applicant.

- Any utility bill attached with the name and address of the applicant.

How to Fill Out a Credit Report Dispute Form?

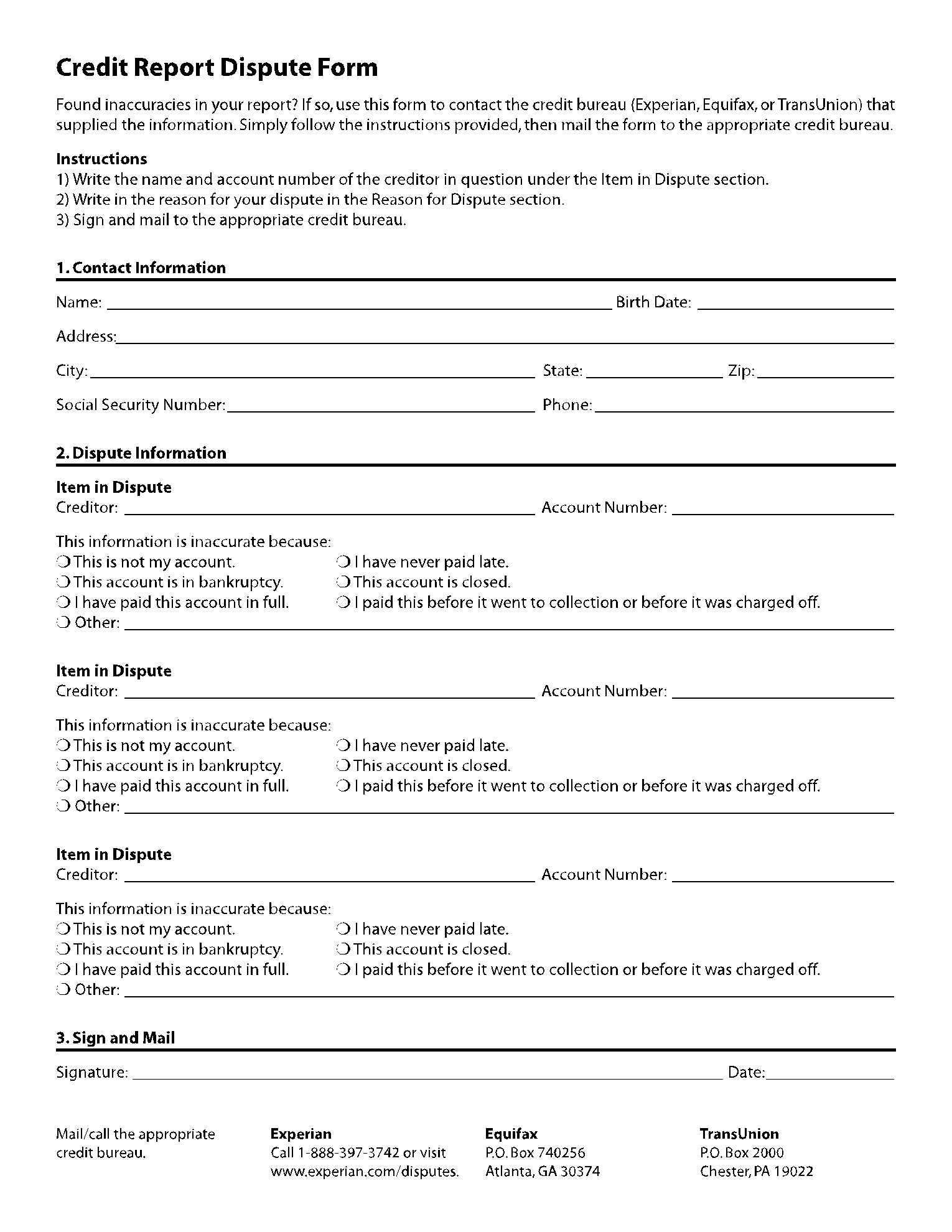

A credit report dispute form can be filled with ease. There are no such technical difficulties that are associated with filling out the dispute form. While filling out the 604 act letter, the necessity of attaching all necessary documents is the only thing that needs to be fulfilled to perfection. However, when filling out a Credit Report Dispute form, the user needs to follow the process as explained below.

Step 1: Firstly, provide the contact information details of the applicant. You are required to add in your name, address, birth date, city, state, postal zip code, Social Security Number, and phone number.

Step 2: As you are done with the personal information within the 604 act letter, you need to add dispute information. Please provide the details of the creditor and their account number that is considered under dispute. It is also important to mark the reason that led to the dispute across the credit report.

Step 3: Once all the items in dispute are marked across the Credit Report Dispute form, you need to sign the form and add in the submission date.

Who Needs a Credit Report Dispute Form?

There is no list of reasons that can be associated with a Credit Report Dispute Form. A 604 act letter is only considered under conditions where there are discrepancies mentioned in a credit report. Differences in credit reports directly affect the credit score of the user, which affects the borrowing opportunities.

These borrowing opportunities can involve renting a house or applying for a job. Since this is a matter of reputation, the user needs to clear out all issues with their credit report. Thus, a credit report dispute form is filed and considered to remove all the speculations created with the items in dispute.

Additional Credit Report Dispute Form Resources

- https://files.consumerfinance.gov/f/documents/092016_cfpb__CreditReportingSampleLetter.pdf

- https://www.consumer.ftc.gov/articles/sample-letter-disputing-errors-credit-reports-business-supplied-information

- https://www.consumer.ftc.gov/articles/pdf-0093-annual-report-request-form.pdf

- https://www.usa.gov/credit-reports